Please refer to important disclosures at the end of this report

1

Sapphire Foods India Limited (SFIL) was incorporated on November 10, 2009.

Sapphire Foods is YUM’s largest franchisee operator in the Indian subcontinent

with revenue from operations of ₹1,340 crore and ₹1,020 crore for the financial

years 2020 and 2021, respectively. Company’s association with Yum started in

2015 and they presently have the non-exclusive rights to operate restaurants

under 3 of YUM’s leading brands, namely, the KFC, Pizza Hut and Taco Bell

brands in the Territories. As of June 30, 2021, they owned and operated 209

KFC restaurants in India and the Maldives, 239 Pizza Hut restaurants in India,

Sri Lanka and the Maldives, and 2 Taco Bell restaurants in Sri Lanka. Total

number of restaurants are 450 as of June 30, 2021.

Positives: (a) YUM's largest franchise operator in the Indian subcontinent in terms

of revenue (b) Portfolio of well recognized global brands across spectrum (c)

Scalable business model (d) Experienced Board and senior management team.

Investment concerns: (a) SFIL is making continuous losses on bottom-line front,

hence profit concerns remain; (b) Slowdown in the economy could impact the

overall revenue of the company (discretionary in nature).

Outlook & Valuation:

In terms of valuations, the post-issue FY21 EV/Sales works out 7.4x to (at the

upper end of the issue price band), which is low compared to its peers Devyani

International (FY21 EV/Sales -16.3x). Further, Sapphire Foods India has a better

revenue per store compared to Devyani International. On the EBITDA front, the

company is continuously showing improvement. Considering all the positive

factors, we believe this valuation is at reasonable levels. Thus, we recommend a

subscribe rating on the issue.

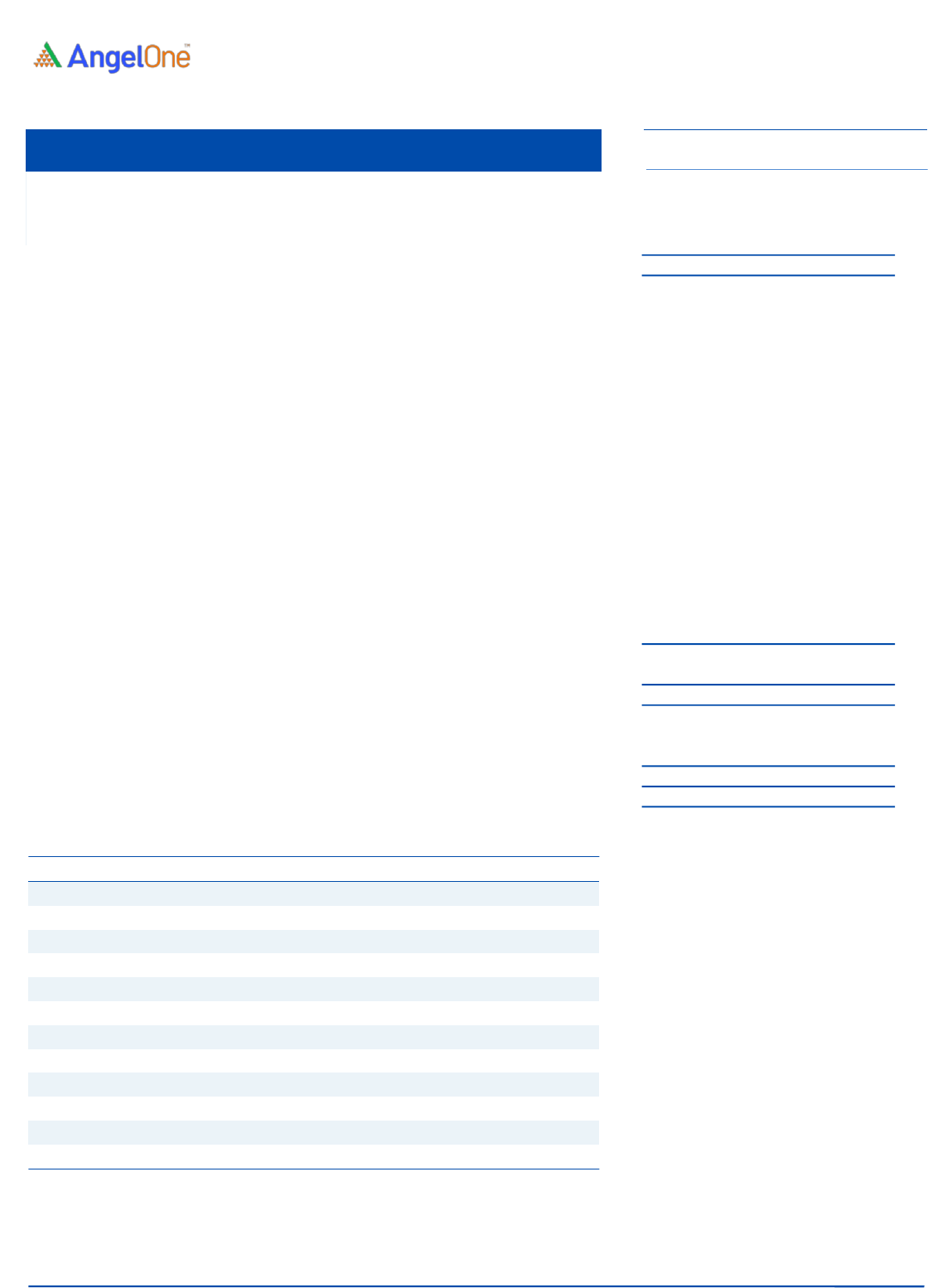

Key Financials

Y/E March (Rs cr)

FY2019

FY2020

FY2021

1QFY21

1QFY22

Net Sales

1,194

1,340

1,020

111

303

% chg

-

12.3

(23.9)

-

173.0

Net Profit

(45)

(158)

(98)

(75)

(26)

% chg

-

431.7

309.9

-

-

OPM (%)

3.2

6.8

12.2

(7.9)

11.2

EPS (Rs)

(8.5)

(29.8)

(18.7)

-

-

P/E (x)

-

-

-

-

P/BV (x)

13.2

11.9

13.0

-

RoE (%)

-

-

-

-

RoCE (%)

-

-

-

-

EV/Sales (x)

5.1

5.1

6.7

-

EV/EBITDA (x)

159.2

74.8

54.6

-

Angel Research; Note: Valuation ratios based on pre-issue outstanding shares and at upper end

of the price band

SUBSCRIBE

Issue Open: Nov 09, 2021

Issue Close: Nov 011, 2021

Offer for Sale: `2,073cr

QIBs 75%

Non-Institutional 15%

Retail 10%

Promoters 50.0%

Public 50.0%

Fresh issue: Nil

Issue Details

Face Value: `10

Present Eq. Paid up Capital: `52.8cr

Post Issue Sha reholding Pattern

Post Eq. Paid up Capital: `63.5cr

Issue size (amount): `2,073cr

Price Band: `1,120-1,180

Lot Size: 12 shares

Post-issue mkt.cap: `7,117*– 7,498cr**

Promoter holding Pre-Issue: 60.1%

Promoter holding Post-Issue: 50.0%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Sapphire Foods India Limited

f

IPO Note | Food & Beverage

November, 08, 2021

Sapphire Foods India Ltd | IPO Note

November 8, 2021

2

Company background

Sapphire Foods India Limited was incorporated on November 10, 2009. Sapphire

Foods is YUM’s largest franchisee operator in the Indian subcontinent with revenue

from operations of ₹1,340 crore and ₹1,020 crore for the financial years 2020 and

2021, respectively.

Company’s association with Yum started in 2015 and they presently have the non-

exclusive rights to operate restaurants under 3 of YUM’s leading brands, namely,

the KFC, Pizza Hut and Taco Bell brands in the Territories.

They are also Sri Lanka’s largest international QSR chain in terms of revenue for

the financial year 2021 (with revenue of ₹190 crore representing 35% of the total

market revenue) and number of restaurants operated as of March 31, 2021 (with

68 restaurants representing 39% of the total number of outlets in the market). They

have also established a presence in the Maldives.

As of June 30, 2021, they owned and operated 209 KFC restaurants in India and

the Maldives, 239 Pizza Hut restaurants in India, Sri Lanka and the Maldives, and 2

Taco Bell restaurants in Sri Lanka. Total number of restaurants are 450 as of June

30, 2021.

Issue details

Sapphire Foods India is raising ₹2,073cr through offer for sale by the company’s

shareholder.

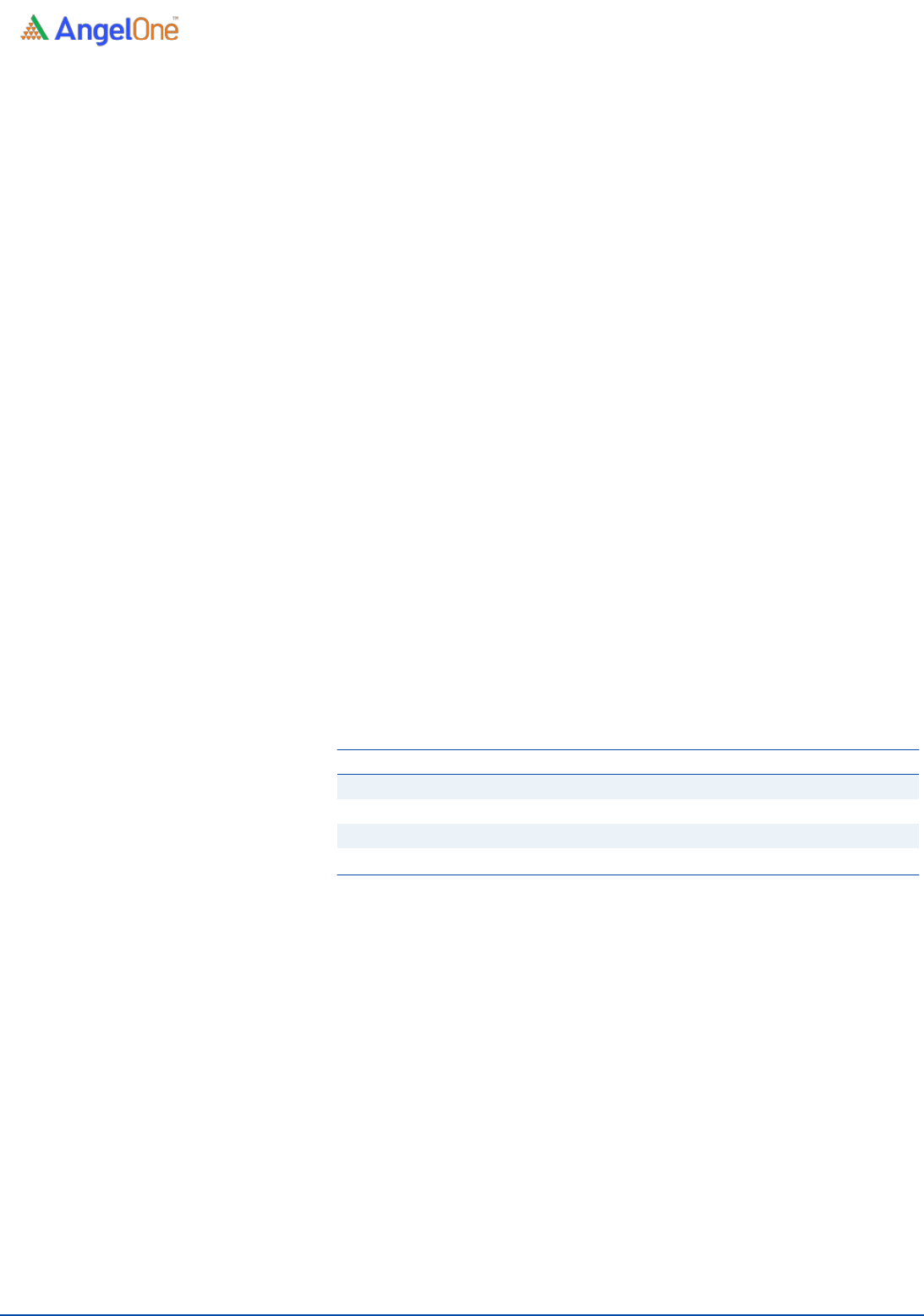

Exhibit 1: Pre and post IPO shareholding pattern

No of shares

(Pre-issue)

%

(Post-issue)

%

Promoter

38,173,680

60.1%

31,752,208

50.0%

Public

25,368,861

39.9%

31,790,333

50.0%

Total

63,542,541

100.0%

63,542,541

100.0%

Source: Source: RHP, Note: Calculated on upper price band

Objectives of the Offer

Carry out the offer for sale of up to 1.75cr equity shares by the selling

shareholders,

Achieve the benefits of listing the equity shares on the stock

exchanges, and

Enhancement of company’ s brand name amongst existing and

potential customers and creation of a public market for equity shares

in India.

Sapphire Foods India Ltd | IPO Note

November 8, 2021

3

Exhibit 2: Consolidated Income Statement

Y/E March (` cr)

FY2019

FY2020

FY2021

Net Sales

1,194

1,340

1,020

% chg

12.3

(23.9)

Total Expenditure

1,155

1,249

895

Raw Material

395

432

310

Personnel

208

229

196

Others Expenses

553

589

390

EBITDA

39

91

124

% chg

136.5

36.4

(% of Net Sales)

3.2

6.8

12.2

Depreciation& Amortisation

74

191

209

EBIT

(36)

(100)

(85)

% chg

179.7

(15.3)

(% of Net Sales)

(3.0)

(7.5)

(8.3)

Interest & other Charges

18

72

76

Other Income

10

11

62

(% of PBT)

(22.4)

(7.0)

(62.4)

Share in profit of Associates

-

-

-

Recurring PBT

(44)

(161)

(99)

% chg

269.6

(38.7)

Tax

1

(2)

1

(% of PBT)

(2.5)

1.1

(1.2)

PAT (reported)

(45)

(159)

(100)

Basic EPS (`)

(8.5)

(29.8)

(18.7)

% chg

252.7

(37.5)

Source: Company, Angel Research

Sapphire Foods India Ltd | IPO Note

November 8, 2021

4

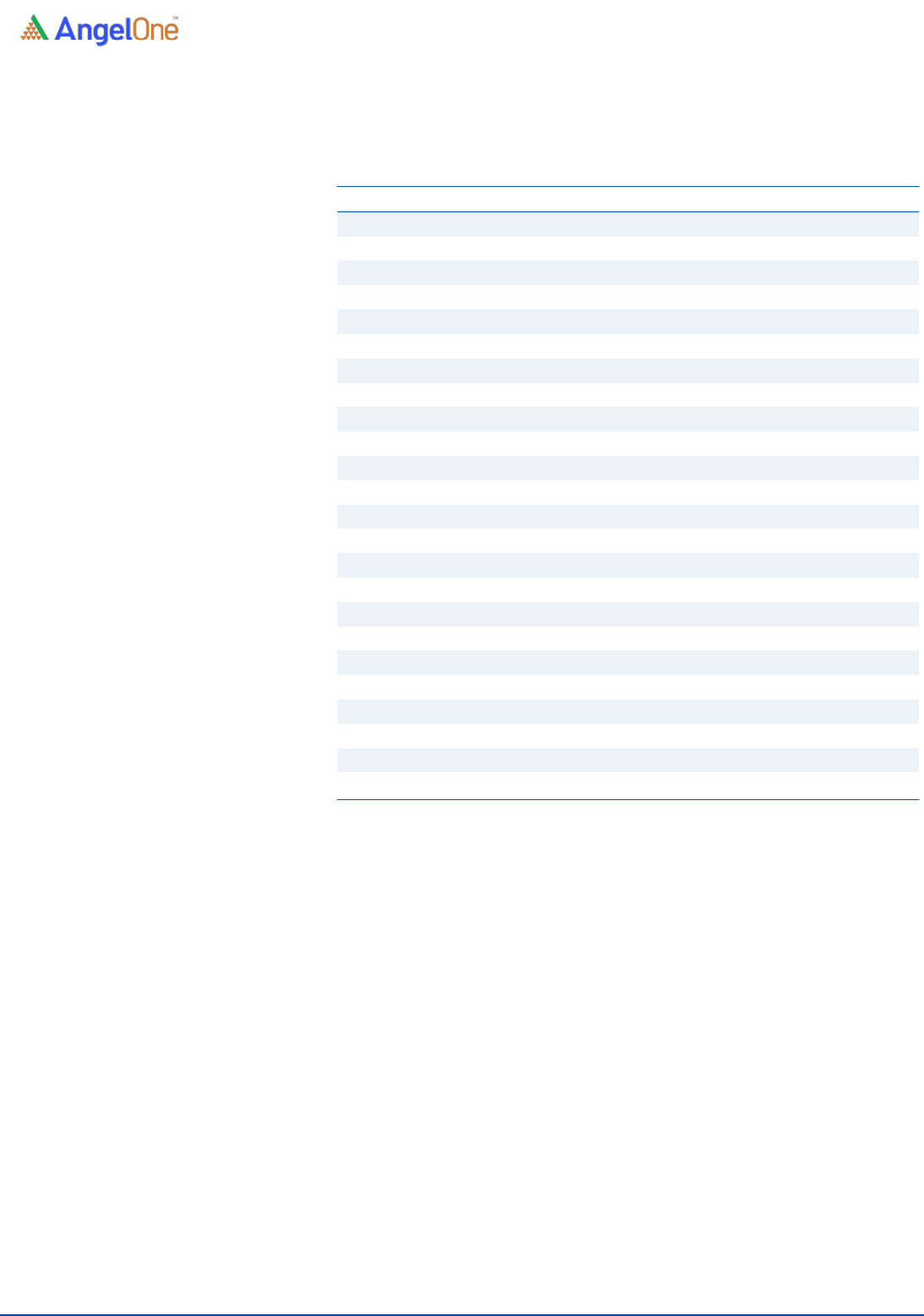

Consolidated Balance Sheet

Y/E March (` cr)

FY2019

FY2020

FY2021

SOURCES OF FUNDS

Equity Share Capital

43

50

53

Reserves& Surplus

429

474

427

Shareholders Funds

472

524

480

Total Loans

96

646

645

Deferred Tax Liability

17

12

11

Total Liabilities

587

1,182

1,134

APPLICATION OF FUNDS

Net Block

719

1,161

1,084

Capital Work-in-Progress

21

21

30

Investments

-

16

27

Current Assets

355

186

208

Inventories

38

47

48

Sundry Debtors

22

5

8

Cash

186

39

50

Loans & Advances

16

74

75

Other Assets

92

20

28

Current liabilities

508

202

215

Net Current Assets

(153)

(16)

(7)

Deferred Tax Asset

-

-

-

Total Assets

587

1,182

1,134

Source: Company, Angel Research

Sapphire Foods India Ltd | IPO Note

November 8, 2021

5

Consolidated Cash Flow Statement

Y/E March (` cr)

FY2019

FY2020

FY2021

Profit before tax

(44)

(161)

(99)

Depreciation

74

191

209

Change in Working Capital

(1)

18

15

Interest / Dividend (Net)

8

62

70

Direct taxes paid

(4)

(3)

(3)

Others

12

105

(38)

Cash Flow from Operations

47

213

154

(Inc.)/ Dec. in Fixed Assets

(174)

(142)

(73)

(Inc.)/ Dec. in Investments

(161)

140

(5)

Cash Flow from Investing

(335)

(2)

(78)

Issue of Equity

0

0

44

Inc./(Dec.) in loans

66

(82)

(18)

Dividend Paid (Incl. Tax)

0

0

0

Interest / Dividend (Net)

216

(126)

(78)

Cash Flow from Financing

281

(208)

(52)

Inc./(Dec.) in Cash

(7)

3

25

Opening Cash balances

30

15

17

Closing Cash balances

22

17

42

Source: Company, Angel Research

Sapphire Foods India Ltd | IPO Note

November 8, 2021

6

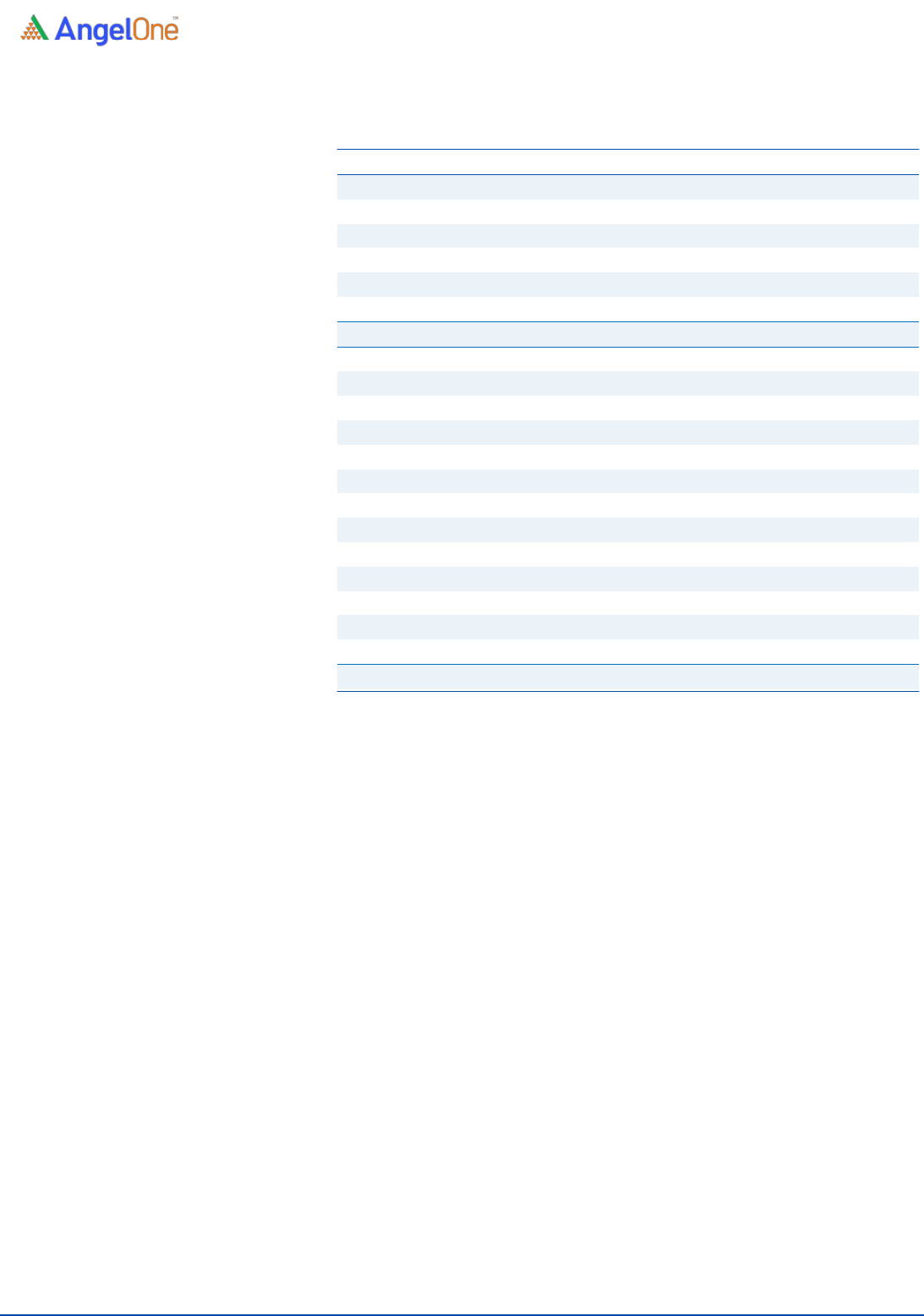

Key Ratios

Y/E March

FY2019

FY2020

FY2021

Valuation Ratio (x)

P/E (on FDEPS)

-

-

-

P/CEPS

209.8

194.3

57.0

P/BV

13.2

11.9

13.0

EV/Sales

5.1

5.1

6.7

EV/EBITDA

159.2

74.8

54.6

EV / Total Assets

10.5

5.8

6.0

Per Share Data (Rs)

EPS (Basic)

(8.5)

(29.8)

(18.7)

EPS (fully diluted)

(8.5)

(29.8)

(18.7)

Cash EPS

5.6

6.1

20.7

Book Value

89.4

99.3

90.9

Returns (%)

ROCE

-

-

-

Angel ROIC (Pre-tax)

-

-

-

ROE

-

-

-

Turnover ratios (x)

Asset Turnover (Net Block)

1.7

1.2

0.9

Inventory / Sales (days)

12

13

17

Receivables (days)

7

1

3

Payables (days)

39

40

57

Working capital cycle (ex-cash) (days)

(20)

(26)

(37)

Source: Company, Angel Research

Sapphire Foods India Ltd | IPO Note

November 8, 2021

7

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: ww.angelone.in

DISCLAIMER

Angel One Limited (formerly known as Angel Broking Limited) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National

Commodity & Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment

Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity with SEBI for

Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates

has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is

for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any

loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any

representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking

Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or

other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement

1.Financial interest of research analyst or Angel or his Associate or his relative No

2.Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives No

3.Served as an officer, director or employee of the company covered under Research No

4.Broking relationship with company covered under Research No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15%)

Hold (Fresh purchase not recommended)